In Texas, health insurance is as complex as it is critical. Take Mary, for example, a resident of Fort Worth, struggling to navigate the murky waters of health insurance pricing. She, like many Texans, faces the daunting task of deciphering the actual cost of health insurance, lost in a sea of hidden costs and a myriad of plans that create an ocean of numbers. Her frustration is palpable, representing a widespread issue that Texans face every day – the baffling complexity and opacity of health insurance pricing.

Are You Confused About Health Insurance Costs?

Texans start open enrollment this week.

Open enrollment is here, and with it comes a flood of Texans trying to understand the crazy world of health insurance. Many, like Mary, are left flustered and confused. Why? A significant part of the confusion stems from the pricing. The monthly premiums, a focal point for most, are just the tip of the iceberg when it comes to determining what exactly your health care costs.

One of the biggest complaints that our agents hear is that the prices are too high and the insurance doesn’t cover what they need.

Feedback from Texans mirrors Mary's exasperation. High prices coupled with inadequate coverage are the common cries. Especially when looking at prescription drugs. Understanding the real cost of health insurance is not just about monthly premiums but also about comprehending what medical expenses these plans truly cover. And more importantly, what they don't.

How should Texans be looking at the cost of health insurance?

The focus shouldn't just be on premiums. Texans need a broader perspective, encompassing all potential costs associated with health insurance given that the average health insurance premiums continue to soar and the health benefits seem to continually shrink. This comprehensive approach is critical in making informed decisions about health coverage and evaluating all options available from the health insurance companies.

Why Is It Important to Understand the Total Cost of Health Insurance?

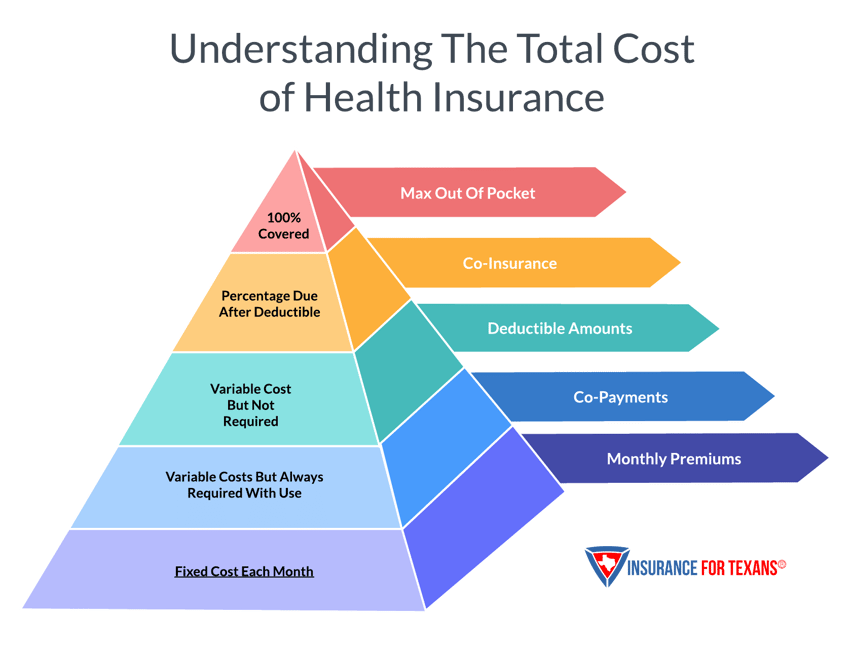

Understanding the total annual cost is imperative to finding a plan that aligns with both healthcare needs and household budget constraints. The total cost of health insurance isn't limited to monthly premiums; it encompasses deductibles, office visits, prescriptions, and other health care expenses that may be lurking in your checkbook later. Recognizing these expenses empowers Texans like Mary to budget effectively and gain control over their health care spending.

The Cost Of Health Insurance Is More Than Just The Monthly Premium

Often overlooked are the elements beyond the monthly premium – the copayments and out-of-pocket expenses that frequently burden family budgets. The total cost of health insurance, therefore, is an aggregate of all health expenses, including co-payments, deductibles, coinsurance, and other out-of-pocket spending that comes when you try to use your health insurance throughout the year. Understanding these elements is key to gauging the true cost of a health plan.

Types of Individual & Family Health Insurance Plans

Texans have many choices during the open enrollment period.

Open enrollment presents a wide variety of choices for Texans. Beyond the much-discussed marketplace plans, there are numerous other options available across the Health Insurance Marketplace. Each type of plan comes with distinct cost implications while carrying different benefits. Identifying the right plan for a Texas family goes beyond the surface level of monthly premiums given how much we allocate to health spending. So what options are available to Texans to take care of your health care services this year?

Catastrophic Health Plans

Catastrophic Coverage offers unique features and benefits. They are tailored for major events, focusing less on routine primary care. These plans are instrumental in providing coverage for critical illness, accidents, and offering indemnity protection for substantial out-of-pocket costs. Understanding how these plans differ from more traditional options is vital for Texans looking for specific types of coverage since they do not interact with your Primary Care activities with your health care provider. But their lower premiums make them look appealing to many families.

ACA Marketplace Plans

Exploring ACA Exchange plans reveals a range of options from Bronze to Gold plans, each with varying monthly costs dependent on factors like age and family size. Regardless of the plan chosen, it's reassuring to know that pre-existing conditions are always covered. This coverage spectrum offers Texans the flexibility to select a plan that best suits their needs and budget and include essential health benefits at no out of pocket costs to Texans.

High Deductible Health Plans (HDHPs)

High Deductible Health Plans require individuals to pay 100% of their healthcare expenses out-of-pocket until a specified deductible is met. With average deductibles and maximum out of pocket amounts for ACA marketplace plans exploding, these plans have become attractive. These health plans typically fall into the Bronze or Silver tier and present a significant cost consideration for Texans given the lower maximum out of pocket on them. It's important to understand the features and benefits of HDHPs, particularly for those who might prefer lower monthly premiums in exchange for higher potential out-of-pocket expenses.

Private Health Plans

Diverse private health plans, like Preferred Provider Organizations and short-term medical plans can offer alternatives in coverage, network restrictions, and out-of-pocket costs. These plans can have reduced benefits while still providing robust protection to families. Texans with pre-existing conditions should note that these plans might exclude such conditions or decline you altogether. Understanding the nuances of these plans is essential for making an informed decision.

How Much Does Health Insurance Cost?

Health Insurance Costs are more than just a monthly premium.

The true cost of health insurance encompasses all the costs your family incurs, not just the monthly premiums. This broader view is essential for understanding the financial commitment involved in securing health coverage no matter which plan that you select. We break down the average cost based on several factors and how you typically use your type of insurance plan. Here are five key factors for you to consider.

Monthly Premiums

This is the obvious first factor. Monthly premiums represent the regular payments made to insurance companies for health coverage to be in place. These premiums vary significantly based on factors like plan type and the insurance company itself. But this is simply the first step for anyone navigating the health insurance market.

Co-Payments

Co-payments are a standard feature of many health plans, and are typically required for doctor visits or prescriptions. It's important to understand that these payments are often still necessary even after meeting deductibles and maximum out-of-pocket expenses. They represent an ongoing cost that can add up over time, influencing the overall financial burden of a health plan. Especially if you have a chronic condition that can require routine doctor visits with a regular prescription as well. Don't overlook this cost factor.

Deductibles

Deductibles are a fundamental aspect of most health insurance plans, directly impacting out-of-pocket costs. They represent the amount paid by the insured before the insurance coverage kicks in and begins to cover your in network services. The mistake many Texans make with deductibles is that they believe that is the maximum that they may have to pay for medical services each year. But your annual deductible may not provide that luxury. Which takes us to the next factor to consider.

Coinsurance

Coinsurance is another cost-sharing method where the insured pays a certain percentage of the healthcare costs that are billed to the health insurance company. This system can vary significantly between plans, and understanding these percentages is essential for calculating potential out-of-pocket expenses. These out of pocket expenditures typically begin when a deductible is met, but an out of pocket maximum has not.

Maximum Out Of Pocket

The concept of maximum out-of-pocket limits acts as a financial safety net within health insurance plans. This limit includes deductibles, copayments, and coinsurance payments to cap the total amount an individual will have to spend in a year for health care expenses. The good news for Texas families is that in network, covered healthcare is provided at no cost once this number is met. With the possible exception of copays. So this will be the ultimate amount of money that you have at risk. Understanding how this limit works is vital for financial planning and risk assessment.

How Can Texans Save On Health Insurance?

It’s important to evaluate all options available.

When enrolling in health plans, considering all available options, including Private Health Plans, Catastrophic Health Plans, and Short Term Medical Plans, alongside ACA Exchange Plans, is essential for finding the most cost-effective solution. How you utilize your healthcare will guide you to which options to consider. But which plans can help Texans like Mary save the most money?

Government Subsidies on ACA Exchange Plans

Government subsidies on ACA exchange plans help make health insurance more affordable. Using premium tax credits and cost-sharing reductions that are based on projected income can help Texans benefit from these financial aids. For lower income families, this is what makes the Federal Exchange Health Plans so appealing.

Reducing Unwanted Coverage

Strategically reducing unwanted coverage can lower overall health insurance costs. For instance, using a direct primary care doctor for routine needs or opting for catastrophic plans can be more cost-effective for those with infrequent medical needs. Older individuals who don't require maternity care might find private health plans without these benefits more suitable, thus tailoring coverage to actual needs. We have a network of cash doctors who can provide services and eliminate coverage for things that you do not need on affordable plans.

High Deductible Health Plans

High Deductible Health Plans (HDHPs) can be a viable option for those willing to pay higher upfront costs in exchange for lower premiums. These plans can potentially reduce maximum out-of-pocket costs, significantly affecting the total cost of health insurance. Understanding HDHPs and their suitability for your specific needs is a way to lower your overall spend.

Evaluating The Total Cost Of Health Care

A thorough evaluation of the total cost of health care involves considering not only premiums but also deductibles and out-of-pocket expenses. These costs can vary significantly between insurance plan types, and understanding these variations is essential for making an informed decision.

Getting A Square Deal in Texas

For Texans to manage their out-of-pocket costs effectively, they need to look beyond the monthly premiums. Access to preferred doctors and hospitals, understanding network restrictions, and working with knowledgeable and solution-oriented insurance agents are crucial elements for navigating the health insurance landscape. This comes when you work with a seasoned independent health insurance agent.

Speak to Insurance For Texans

At Insurance for Texans, we understand the complexity and confusion that often comes with selecting the right health insurance plan. Our independent agents are committed to prioritizing your needs, providing you with the education and options you need to make the best decision for your circumstances.

Understanding health insurance in Texas requires a deep dive into not just the visible costs like premiums but the less apparent ones such as deductibles, copayments, and coinsurance. By considering all these factors, Texans can make more informed decisions, ensuring they select a health insurance plan that aligns with their health needs and financial capabilities. Our team at Insurance for Texans is here to help guide you through this process, offering expertise and personalized support every step of the way.

Click the button below to start your journey toward demystifying health insurance costs and finding a plan that suits your needs and budget.