Flood insurance is a type of insurance that can be mandated by a lender when you take a mortgage on a property, but isn't always required. A frequent question at Insurance for Texans is whether or not a home is in a flood zone. As people are shopping for new homes and purchasing homeowners insurance, they can be confronted with the reality of this question. So spill the beans already. Is my home in a flood zone?

Yes! You're In A Flood Zone

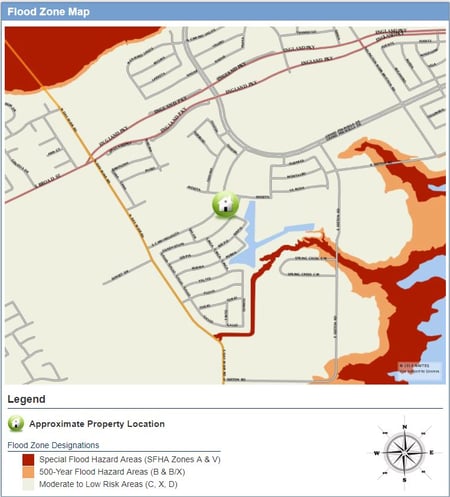

What you probably don't realize is that all homes are put into a flood zone of some kind. So yes, your home is in fact in a flood zone. What matters is what zone it is placed into when a map is drawn. The base level of flood zones is what is known as Zone X, which is indicative of chance of flooding of 0.2% or less. Otherwise known as the 500 year flood zone. The vast majority of homes will fall into this category and your lender will likely not mandate that you carry a flood insurance policy on your home. On the opposite end of that spectrum are the Special Flood Hazard Area (SFHA) which is indicative of a 1% or greater chance of flooding each year. Otherwise known as the 100 year flood zone. You will be required by your lender to have flood insurance on your home if you fall into this category. There are also zones in between Zone X and the SFHA which are classified as moderate flood hazards and will likely result in your lender requiring a flood insurance policy.

How Does My Home Get Classified

To determine the specific zone that your home or building falls into, they use what is known as a Flood Insurance Rate Map (FIRM). The map breaks down every property into the zones described previously and are based on elevation work that is done by surveyors. The maps are periodically updated to promote accuracy. The frequency of update can be greatly accelerated by areas of high development and construction as watersheds are frequently altered during that process. Maps can be updated on a one-off basis using what is known as a Letter of Map Change (LOMC). This will be based off of a survey that can be submitted to FEMA to get a determination to change to your property's zone status. The survey will cost you a fee to a surveyor, but can have a substantial impact upon the amount of money that you pay for flood insurance if the map is changed in your favor.

What Happens If I Don't Get Flood Insurance

The results of this question really fall into two categories. If you are are required by your lender to carry flood insurance and you do not secure coverage, they will obtain flood insurance for you. This process is known as forced placed insurance and it is very expensive. More so than purchasing coverage for yourself.

If you are not required by your lender to carry flood insurance and you do not obtain insurance nothing will happen to you. Unless there is a flood. At that point, you will be expected to take care of your home and possessions without assistance. You can often land some assistance from FEMA or other agencies to help you rebuild and replace, but your Texas homeowners insurance will not be able to help you as it excludes flood insurance coverage.

What Can I Do To Get Coverage

The great news for you is that there are options for obtaining flood insurance. Insurance for Texans can help you get the right flood insurance policy for your situation. As Independent Insurance Agents, we work with many markets to help you properly protect your valued possessions from floods. Speak with one of our agents today!