Does Business Insurance Confuse You?

Do You Find Insurance For Your Business Confusing?

Working with Texas Business Owners through the years, the agents at Insurance For Texans have heard many frustrations and questions regarding insurance. Whether it be the policies for the business itself, or the benefits that they provide their employees, it always seems overly complicated!

As a result, we have put all of those frustrations and questions down on paper to find common threads, so that we could put together an easier to understand guide for Business Owners just like you!

It doesn't matter if your business is in Amarillo, Austin, Ft Worth, Abilene, Waco, Midland-Odessa, or even in multiple locations around this great state; you deserve to work with someone that speaks Texan!

Let us help you untangle the confusion of Commercial Texas Insurance!

The Basics of Business Insurance For Texans

Business is BOOMING in Texas. Native sons and daughters start their own new businesses everyday. It seems like an out of state company is relocating to San Antonio, Houston, Austin, or Dallas-Ft Worth almost every day. Companies that have been in Texas for what seems like ever are being faced with new challenges while pushing to succeed in innovative new ways. The last thing you want to worry about as a business owner is if something is covered.

Because of this worry, Insurance For Texans has distilled the most common points of coverage down into easy to understand bite size chunks. This allows you, the great business owners of Texas, to get quick answers to questions that you may not find elsewhere. Nevermind that we speak Texan just like you do.

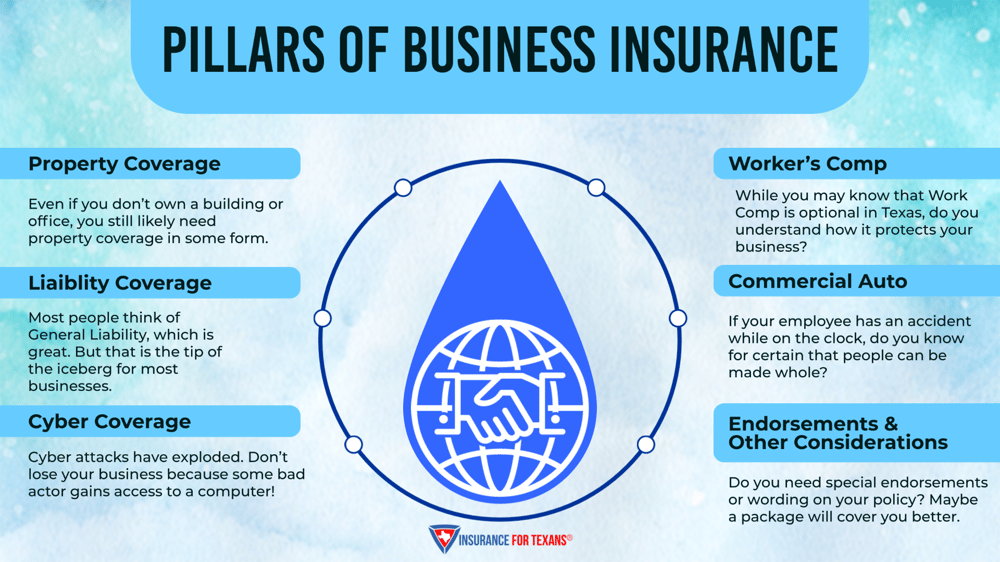

Below, we break down the topics of Property Coverage, Liability Coverage, Cyber Coverage, Worker's Comp, Commercial Auto and Endorsements. Our goal is to directly educate you so that you are empowered to have a conversation about covering your business the right way. If you'd like clarification on any of these items, we are happy to help you with those needs. Simply give us some quick information here to start that process.

Property Coverage on your Texas business can mean many different things depending upon your circumstances. We start with your location and if you're responsible for replacing it or the improvements that you've made to the place in the event of a major event upsetting your business. However, it doesn't stop there since you have tools, equipment, inventory, and/or customer gear there. Click the links below to find out the what and how for each topic.

- Property

- Tenants Improvements & Betterments

- Triple Net Lease Provisions

- Business Personal Property

- Tools (Inland Marine)

- Customer Items (Bailee's Coverage)

- Inventory

- Business Income

Liability Coverage on your business comes in many forms. The key thing to remember is that people can sue you for just about anything at any time. Knowing that you have defense covered as well as the ability to make someone whole who feels that they were wronged by your business is part of how you sleep at night. Click the links below to find out the what and how for each topic.

- General Liability

- Professional LIability (Errors & Omissions Coverage)

- Media/Advertising Liability

- Directors & Officers

- Pollution

- Completed Products

- Food Born Illness

- Employment Practices Liability

- Umbrella/Excess Liability

Cyber Coverage has two main themes. First is an overwhelming number of ways that your business can be decimated. The second are the mechanisms that put your business back together when the unthinkable happens. Click the links below to find out the what and how for each topic.

- Ransomware

- Malware

- Phishing

- Invoice Manipulation

- Automation/Operational Risks

- Data Theft

- Data Concerns including Personal & HIPAA Data

- Network Restoration

- HIPAA Concerns

- Business Income

- Fines & Reputation Repair

Most Texas Business Owners know that Worker's Comp is optional. What they don't always think about is the level of protection that comes to your business when you carry the coverage. Saving small amounts of money knowing that you can be sued into oblivion doesn't help you sleep at night. Click the links below to find out the what and how for each topic.

- Worker's Comp Requirements Of Businesses in Texas

- Coverage Amounts

- What Is Covered?

- Partial Return To Work

- Lawsuits and Negligence

- Experience Mods

Not every Texas Business has an auto to insure. But that doesn't necessarily mean that you don't need some form of commercial auto insurance. Click the links below to find out the what and how for each topic.

- Liability

- Uninsured/Underinsured Motorist

- Physical Damage To Your Vehicles

- Fixed Attachments To Your Vehicle

- Listed Drivers On A Policy

- Monitoring Your Drivers

- Why Run Motor Vehicle Records on New Hires

- Hired & Non-Owned Auto Coverage

While we've covered a lot of ground so far, endorsements are how policies can become really useful for your complex situation. There are also other considerations that you have to keep an eye on when evaluating a Texas Commercial Insurance Policy. Click the links below to find out the what and how for each topic.

- What is a Business Owner's Policy?

- Composite Deductibles

- Third Party

- Government Requirements

- Certificates of Insurance

- Endorsement Vs Stand Alone Policy